updated 2015-07-20丨International Business Times

By Ravender Sembhy

International Business Times posted an article named “China’s private-sector giants will help country challenge US in global stakes” is written from the interview with Dr. Edward Tse.

“In China, you have these two extremes,” Edward Tse says.

On one side is the state – the Communist Party of China, with its sluggish top-down, albeit successful, state-run sector based on central planning.

On the other is the dynamic, almost celebrity world of internet titans such as Alibaba and Baidu, operating on “a Silicon Valley model: agile, democratic, transparent”.

“These two extremes, the pillars of state and the private sector, coexist in what is a tremendous social experiment.”

Tse, who has worked with hundreds of big-hitting companies as well as the Chinese government, believes that this coexistence will help catapult the economy to even greater heights, despite recent wobbles.

Private sector

The pace and scale of change in the Chinese private sector since economic reforms began in 1978 has been staggering. Back then, there were just 140,000 registered private businesses, making up less than 1% of economic activity. Today, the private sector accounts for more than 35%, with firms such as Tencent and Ziaomi being the big national players.

“This type of company has had to create new ways of doing business, which is sometimes on the borderline. In this respect, the Chinese government has been very lenient because they are boosting the economy and, crucially, many are acting as platforms for SMEs. The Chinese government deserves some credit for fostering conditions for the private sector to grow,” Tse says.

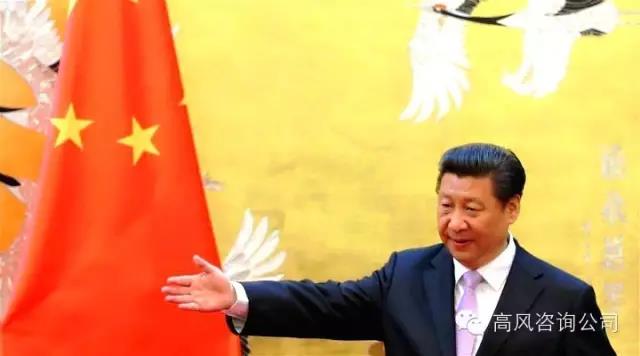

Although China’s President Xi Jinping warned against the “blindness of the market” only last week, the government has recently made a point of saying the country should embrace entrepreneurship and the private sector as much as the state sector.

One way of investing in private companies has been through the Chinese stock exchange, where more than 90 million individual Chinese are directly invested. However, the exchange has seen major ruptures in the past few weeks.

The stock market

Chinese shares have lost more than 30% of their value in the past month

Earlier in July, the China Securities Regulatory Commission barred major shareholders from selling shares on the Shanghai Composite Index for the next six months as it attempts to halt a selling frenzy that has wiped out more than 30% – some $3tn (£1.9tn, €2.7tn) – of China’s equity market value over the past month.

The move prompted a flurry of criticism from observers who have been worried that state interference would impact upon share prices negatively in future, when the ban is lifted.

But Tse is unfazed. “The Chinese government has learned a big lesson, as have small investors. The way they handled the situation was amateurish, and it is amateurish when it comes to capital market regulation. But it should be remembered that the drop doesn’t erase the rise over the past year.”

Most importantly, Tse believes the stock market is not linked to the physical economy and therefore has limited impact on a wider macro level. In fact he sees the turmoil and intervention as a “blip”.

“It was a blip. The government had to act because a lot of people had invested in it, just like when the UK government stepped in in 2008. There will always be ups and downs, but it will normalise when it reopens.”

China’s slide?

Stock market turmoil, coupled with slowing growth, has led many observers to doubt the long-term potential of China’s economic growth.

But Tse has tipped China to rival the US for global dominance, backed by its embrace of entrepreneurialism.

“Entrepreneurs and innovators will be a force to be reckoned with, not just in China but in the rest of the world too. Their rise will represent an opportunity and threat.”

Opportunities will arise for those Western firms who are savvy enough to team up with local Chinese firms and tap the huge market that is opening up. But Western firms “could also end up being disrupted”, with Tse citing the automotive industry as a pivotal sector in this regard.

The net result? “In 10 years, China will be competing with the US for the biggest economy in the world.”

However, Tse says that the Chinese government doesn’t want to replace the US, rather “create another pole”, the foundations of which are rooted in its economic growth.

Edward Tse has recently written a book, China’s Disruptors, which charts the contribution of entrepreneurs to the country’s economic growth.